District

Departments

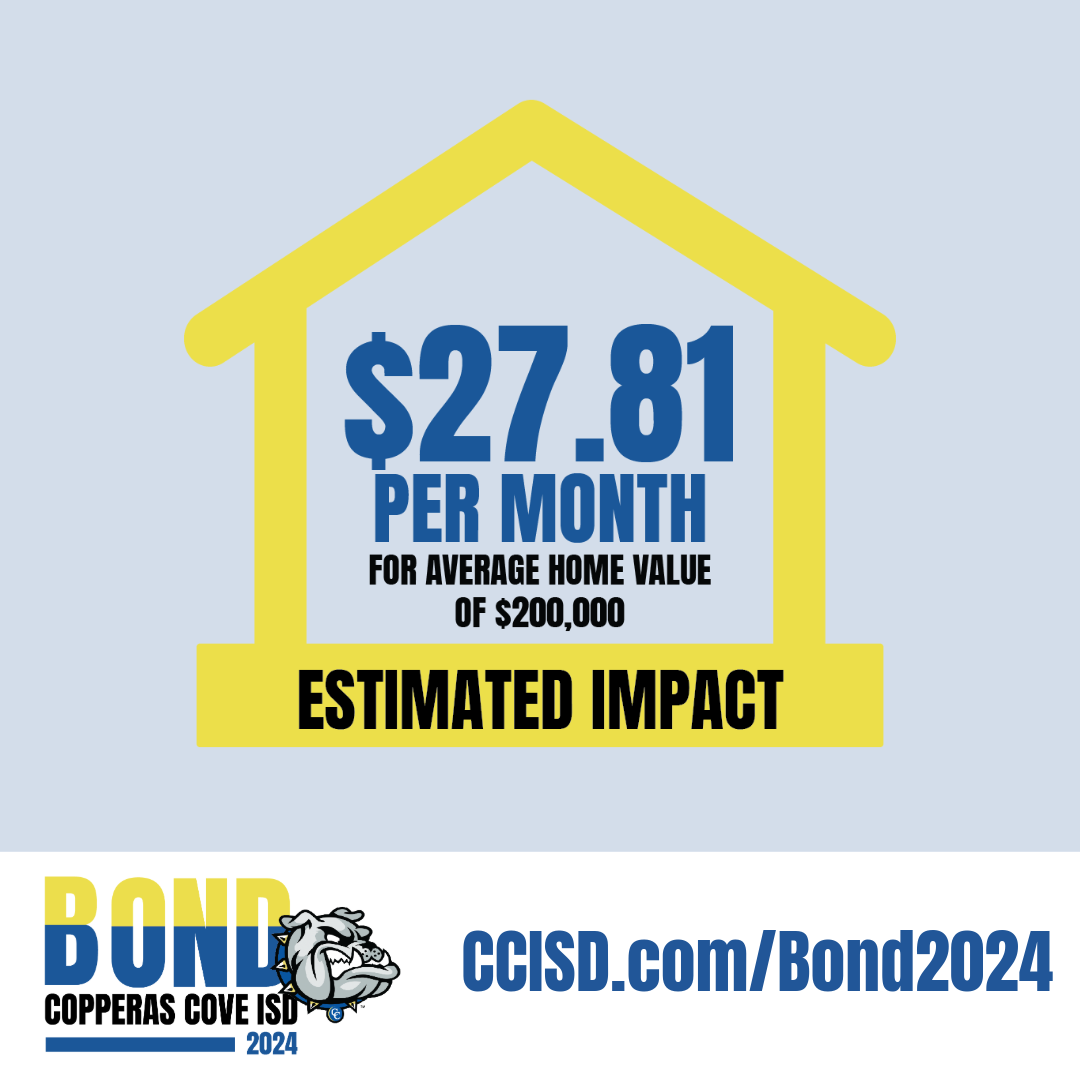

The average home in Copperas Cove ISD is valued at approximately $200,000. If voters approve the proposed bond, the taxes on an average home would increase by $27.81 per month.

Even if the bond is approved, a homeowner with a $200,000 home value will pay approximately $460 less in school taxes than they did in January 2023.

The recently-adopted tax rate for CCISD is $0.8338, which is 18 cents lower than the tax rate adopted in the 2022-23 fiscal year. This is the fifth consecutive year the board has adopted a lower tax rate.

The Interest & Sinking tax rate (also known as I&S) is the only tax rate

which will increase if voters approve the bond proposal. There will be NO

increase to the Maintenance & Operation (also known as M&O) tax rate

The current I&S tax rate for CCISD is $0.0763

The current M&0 tax rate for CCISD is $0.7575